PART 2 - Rescuing TINA with COVIDNOMICS

Warning Signs – An explosive mix of financial and political instability

“Without a supportive state, capitalism would not last a day.” – Robert Heilbroner

BEFORE COVID-19 WAS DECLARED A PANDEMIC, elite policymakers were warning of a looming global financial crisis worse than 2007-’09 that was easily as threatening as the political volatility so clearly on display since at least 2016. Although the twin political and economic crises are inextricably linked, the scale of pre-COVID financial problems was unprecedented.

As always in an economy so heavily dependent on speculation, the problems emerge first in the form of a potential debt crisis. In Q3 of 2019, for example, both the Institute of International Finance (IIF) and the Bank of International Settlements (BIS) reported that global debt was the highest in history.

A May 1, 2020 report from the Congressional Research Service offered the following summary (p 41):

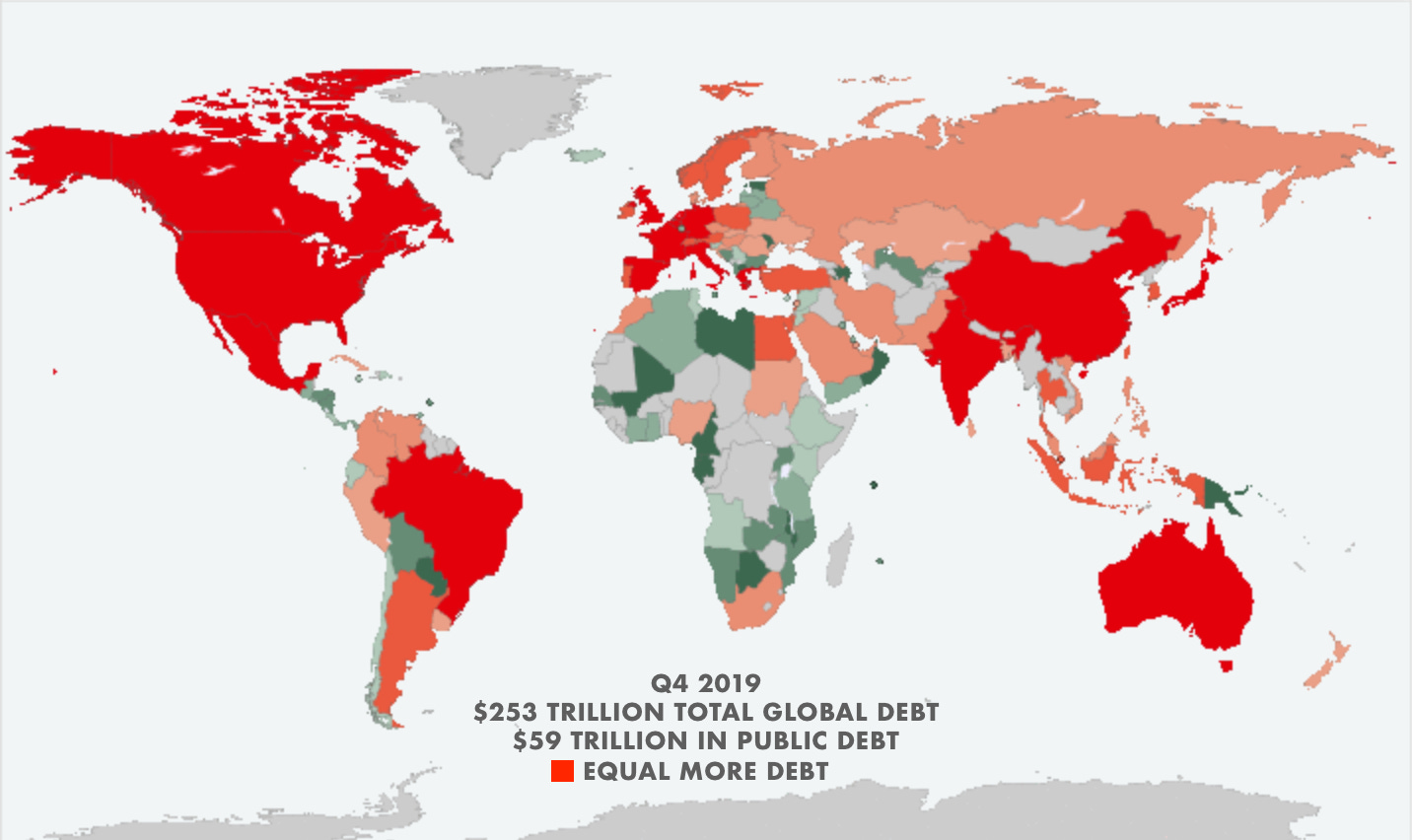

In Q3 2019—before the outbreak of COVID-19—global debt levels reached an all-time high of nearly $253 trillion, about 320% of global GDP. About 70% of global debt is held by advanced economies and about 30% is held by emerging markets. Globally, most debt is held by non-financial corporations (29%), governments (27%) and financial corporations (24%), followed by households (19%). Debt in emerging markets has nearly doubled since 2010, primarily driven by borrowing from state- owned enterprises.

In sum, 81% of this historic debt has been incurred by corporations, banks and the governments that now act as their service organizations. But even this historic debt level understates how fragile and out of control the modern globalized economic order has become, having morphed into a kind of international casino for financial speculators in the absence of meaningful regulation.